Nowadays, financial planning for business owners is not just about managing money. Wise noted that 20% of new businesses fail within 2 years and 65% within 10 years, mostly due to poor planning. So, for beginners and SMEs, this reality makes financial discipline even more crucial. Without it, stability and growth quickly slip away.

Common struggles include unstable cash flow, overspending, and weak forecasting that put profits at risk. With the right approach, however, business owners can build resilience and long-term success. Keep reading to discover how smart financial planning can secure your business future!

Key Takeaways

- Financial planning for business owners requires clear goals and budgets.

- Strong cash flow forecasting helps entrepreneurs manage risks and growth.

- Regular reviews and investments sustain profitability for business owners.

10 Must-Know Financial Planning Tips for Business Owners

To guide you away from common mistakes, we’ll highlight ten tips for the best financial plan for business owners to prioritize. Keep your business on track!

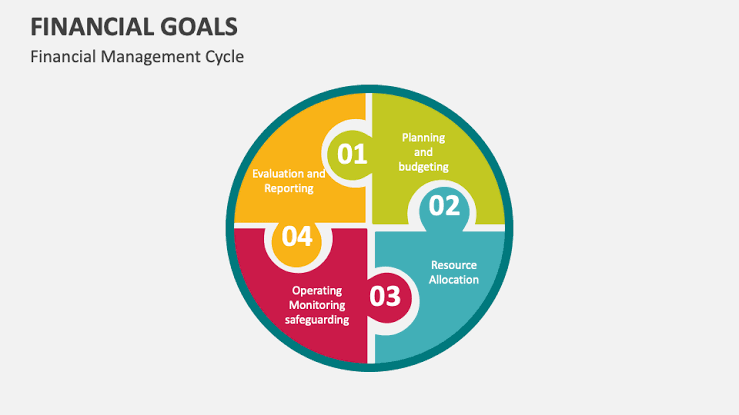

1. Set Clear Financial Goals

Financial Goals | Image Source: collidu.com

The first step in financial planning is setting clear goals, as they guide decisions and prevent wasted resources. By combining short-term targets like monthly sales with long-term aims such as expansion, you keep your plan aligned with your vision. With this balance, planning stays focused, structured, and measurable.

2. Create Realistic Budgets

A budget is more than just numbers. It’s a roadmap that guides spending and saving. By creating a realistic budget, business owners can allocate resources efficiently, ensuring that every dollar is put to good use. Without a budget, it’s easy to overspend or underestimate costs.

Additionally, a budget allows you to compare actual expenses with projected figures. This helps identify discrepancies early and make adjustments. By doing so, you not only prevent financial leaks but also build discipline in managing your company’s money.

3. Cash Flow Forecasting

Cash flow is a core element of financial planning for entrepreneurs, and forecasting helps avoid unexpected shortages. By predicting inflows and outflows, business owners can prepare for upcoming expenses and ensure there’s enough liquidity to cover day-to-day needs.

Furthermore, accurate forecasting makes it easier to plan investments or expansions. Knowing when surplus cash will be available helps you seize growth opportunities, while anticipating tight periods ensures you avoid costly borrowing.

4. Debt and Loan Management

While debt can support growth, poor management often leads to financial strain. Business owners must evaluate repayment capacity before taking loans and avoid borrowing more than necessary. A structured repayment plan will prevent unnecessary interest costs.

At the same time, choosing the right financing option is crucial. Not all loans are equal, and selecting those with favorable terms reduces long-term obligations. By carefully managing debt, you maintain flexibility and protect profitability.

5. Emergency Fund and Risk Management

Emergency Fund | Image Source: nairametrics.com

Unexpected challenges like market downturns or equipment failures can disrupt operations. An emergency fund provides a cushion to keep the business running. In addition, insurance reduces exposure to financial shocks. Together, they form a safety net that ensures continuity.

6. Tax Planning and Compliance

Taxes are a significant expense, yet many business owners overlook proactive planning. As part of financial planning for business owners, staying compliant with regulations avoids penalties and keeps financial records transparent. A well-prepared tax strategy also ensures that deductions and credits are fully utilized.

Working with accountants or using software makes tax preparation easier and more accurate. Moreover, efficient tax planning improves cash flow management, allowing you to reinvest savings back into your business.

7. Profitability Analysis

Since tracking revenue alone is not enough, profitability reveals the true health of a business. Analyzing profit margins helps owners understand whether the company is operating efficiently or overspending in certain areas.

By identifying which products or services yield higher margins, you can refine offerings and focus on the most profitable activities. This data-driven approach ensures that your business maintains a healthy balance between revenue and expenses.

8. Cost Control and Efficiency

Controlling costs is a key part of financial planning for business owners to spend wisely. Business owners should regularly review expenses and eliminate unnecessary spending. Even small reductions can add up and improve overall profitability.

Moreover, adopting efficient processes enhances productivity without increasing costs. For example, automating administrative tasks can free up time for revenue-generating activities. As a result, the business becomes leaner and more competitive.

9. Investment and Growth Planning

Financial planning is also about knowing where to reinvest. Setting aside funds for research, technology, or market expansion helps businesses stay competitive. However, growth must be balanced with stability. Therefore, business owners must weigh risks carefully and ensure that investments align with financial goals.

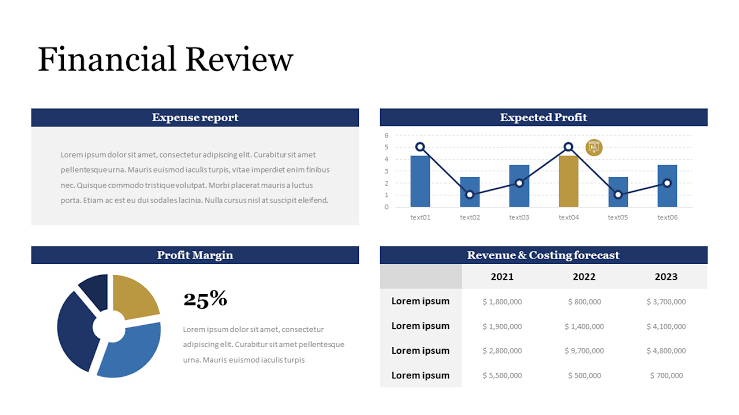

10. Regular Financial Review and Adjustment

Financial Review | Image Source: slidemembers.com

A financial plan must evolve with your business. Regularly reviewing budgets, cash flow, and performance indicators allows owners to make informed adjustments. This process ensures that plans stay relevant and effective. By analyzing reports monthly or quarterly, you can identify trends, address issues early, and capitalize on opportunities.

Secure Long-Term Success Through Financial Planning

Financial planning is not an optional task but a critical responsibility for every business owner. By applying the right financial planning for business owners, they can avoid common mistakes, maintain stability, and position themselves for sustainable growth. Remember, a strong financial plan is the foundation of long-term success!